Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable. A credit to a liability account increases its credit balance. Expenses normally have debit balances that are increased with a debit entry. Since expenses are usually increasing, think „debit“ when expenses are incurred.

Broadly, the general ledger contains accounts that correspond to the income statement and balance sheet for which they are destined. The general ledger functions as a collective summary of transactions posted to subsidiary ledger accounts, such as cash, accounts payable, accounts receivable and inventory. A trial balance is prepared after all the recorded transactions are posted into the ledger…

What Is a Trial Balance?

The income statement might include totals from general ledger accounts for cash, inventory and accounts receivable, which is money owed to the business. They are sometimes broken down into departments such as sales and service, and related expenses. The expense side of the income statement might be based on GL accounts for interest expenses and advertising expenses. At the end of each fiscal period, a trial balance is calculated by listing all of the debit and credit accounts and their totals. Those with debit balances are separated from the ones with credit balances. The debit and credit accounts are then totaled to verify that the two are equal.

Other GL accounts summarize transactions for asset categories, such as physical plants and equipment, and liabilities, such as accounts payable, notes or loans. In the interest of not messing up your books, it’s best to wait until the end of the year to delete old accounts. Merging or renaming accounts can create headaches come tax season. Instead, they show actual amounts spent or received and not merely projected in a budget.

How Do You Match a Trial Balance?

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. A general ledger https://accounting-services.net/petty-cash-accounting-accountingtools/ is an important, fundamental accounting tool. GLs and accounting can be improved using blockchain technology. Learn about ways other industries are using blockchain technology.

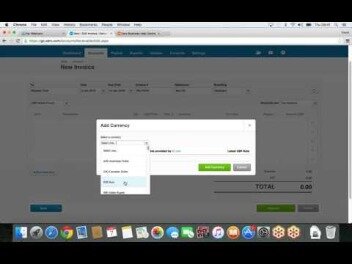

- The video below shows how to categorize transactions in QuickBooks Online and navigate the chart of accounts.

- Expense and revenue accounts make up something called the income statement, which provides insight into a business’s profitability overtime.

- This means that the new accounting year starts with no revenue amounts, no expense amounts, and no amount in the drawing account.

- Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable.

- For example, if journal entries for a debit and its corresponding credit were never recorded, the totals in the trial balance would still match and not suggest an error.

- Most QuickBooks Online plans, for example, support up to 250 accounts.

All three of these types have exactly the same format but slightly different uses. The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed. It is a record of day-to-day transactions and can be used to balance a ledger by adjusting entries.

Company

Businesses prepare a trial balance regularly, usually at the end of the reporting period to ensure that the entries in the books of accounts are mathematically correct. Small businesses with less than 250 accounts might have a different numbering system. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry. To maintain the accounting equation’s net-zero difference, one asset account must increase while another decreases by the same amount.

What shows a list of all accounts and their account numbers?

A chart of accounts is a listing of the names of the accounts that a company has identified and made available for recording transactions in its general ledger. A company has the flexibility to tailor its chart of accounts to best suit its needs, including adding accounts as needed.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. At the end of the year, review all of your accounts and see if there’s an opportunity for consolidation. Many or all of the products featured here are from our partners who compensate us.

Debits and Credits Outline

Since each transaction is listed in a way to ensure the debits equaled credits, the quality should be maintained in the general ledger and the trial balance. If the sum of debits does not equal the sum of credits, an error has occurred and must be located. A chart of accounts is a list of account names used to label transactions and keep tabs on a company’s finances. Think of it as the filing cabinet for your small business’s accounting system. It organizes transactions into groups, which helps track money coming in and out of the company. In accounting, the terms debit and credit differ from their commonplace meanings.

- Many or all of the products featured here are from our partners who compensate us.

- Debits and credits of a trial balance must tally to ensure that there are no mathematical errors.

- With accounting software, business owners don’t have to wait for the end of the year to make a trial balance and assess their financial information.

- Charts of accounts should be organized with simplicity in mind.

- There are no special conventions about how trial balances should be prepared, and they may be completed as often as a company needs them.

Most charts of accounts will look structurally similar to the one shown. For this transaction, the credit column will remain unchanged for this account. However, a separate ledger for the company’s accounts receivable will reflect a credit reduction for the same amount, because ABCDEFGH Software no longer has that amount receivable from its client.

For example, a CPA might use a T-account — named because of its physical layout in the shape of a T — to track just the debits and credits in a particular general ledger account. Certified public accountants (CPAs) and bookkeepers typically are the ones accessing and using general ledgers. Following the accounting equation, any debit added to a GL account will have a corresponding and equal credit entry in another account, and vice versa. A trial balance is so called because it provides a test of a fundamental aspect of a set of books, but is not a full audit of them. The trial balance is the first step toward recording and interesting your financial results. Preparing the trial balance perfectly ensures that the final accounts are error-free.

- Asset, liability, and most owner/stockholder equity accounts are referred to as permanent accounts (or real accounts).

- It organizes transactions into groups, which helps track money coming in and out of the company.

- In some areas of accounting and finance, blockchain technology is used in the reconciliation process to make it faster and cheaper.

- We believe everyone should be able to make financial decisions with confidence.

- For personal accounts, the receiver is debited and the giver is credited while for real accounts, what comes into the business is debited and what goes out of the business is credited.

- Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit.

A trial balance can be used to assess the financial position of a company between full annual audits. Once a book is balanced, an adjusted trial balance can be completed. This trial balance has the final balances in all the accounts, and it is used to prepare the financial statements. The post-closing trial balance shows the balances after the closing entries have been completed. Preparing a trial balance regularly helps a business in spotting errors in its books. With accounting software, business owners don’t have to wait for the end of the year to make a trial balance and assess their financial information.

To prepare a trial balance, you will need the closing balances of the general ledger accounts. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements. The trial balance is made to ensure that the debits equal the credits in the chart of accounts. A trial balance can be used to detect any mathematical errors that have occurred in a double entry accounting system. The totals calculated in the general ledger are then entered into other key financial reports, notably the balance sheet — sometimes called the statement of financial position. The balance sheet records assets and liabilities, as well as the income statement, which shows revenues and expenses.

Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples. Under balance method, only the balances of all the ledger accounts are shown in the trial balance. Create a chart of accounts that doesn’t change much year over year. This way you can compare the performance of different accounts over time, providing valuable insight into how you are managing your business’s finances. This means that the new accounting year starts with no revenue amounts, no expense amounts, and no amount in the drawing account. In this example, the transaction is for a cash payment from a client account to ABCDEFGH Software.